south-sudan.ru

Community

How To Get Instant Paypal Money Free

Earn up to £20 with today's must-have apps. Sign up and choose PayPal as your payment method in up to 4 of these select apps below. Or just link your account. Next, you'll be prompted to follow the instructions to choose between a Standard Transfer and Instant Transfer. The Standard Transfer is free and takes 1 to 3. Stream Earn is a income app for real money games paypal to earn paypal money. Join our free paypal app for paypal cash! Just choose a game and play it. Cash out is instantly into PayPal account. (I have cashed out and got my PayPal credit) New survey everyday. Would recommend. Fantastic app. Instant PayPal. Sign up for free at south-sudan.ru · Take part in online surveys to earn points and cash. · Earn a minimum of $1 and then choose Paypal as your Payment Method. · Get. You can earn free PayPal gift cards for completing different online tasks and activities like shopping online for cash back, redeeming promo codes, or taking. You can get free PayPal cash in several ways. One of the easiest ways to do it is to join one of the survey sites that pay out free PayPal money fast. With Swagbucks. Swagbucks is a popular rewards and cash · Take Online Surveys With Survey Junkie. If you're looking for ways to get free PayPal. Go to Wallet. · Click Transfer Money. · Click Transfer to your bank. · Enter the amount. · Select in minutes. · Follow the instructions. Earn up to £20 with today's must-have apps. Sign up and choose PayPal as your payment method in up to 4 of these select apps below. Or just link your account. Next, you'll be prompted to follow the instructions to choose between a Standard Transfer and Instant Transfer. The Standard Transfer is free and takes 1 to 3. Stream Earn is a income app for real money games paypal to earn paypal money. Join our free paypal app for paypal cash! Just choose a game and play it. Cash out is instantly into PayPal account. (I have cashed out and got my PayPal credit) New survey everyday. Would recommend. Fantastic app. Instant PayPal. Sign up for free at south-sudan.ru · Take part in online surveys to earn points and cash. · Earn a minimum of $1 and then choose Paypal as your Payment Method. · Get. You can earn free PayPal gift cards for completing different online tasks and activities like shopping online for cash back, redeeming promo codes, or taking. You can get free PayPal cash in several ways. One of the easiest ways to do it is to join one of the survey sites that pay out free PayPal money fast. With Swagbucks. Swagbucks is a popular rewards and cash · Take Online Surveys With Survey Junkie. If you're looking for ways to get free PayPal. Go to Wallet. · Click Transfer Money. · Click Transfer to your bank. · Enter the amount. · Select in minutes. · Follow the instructions.

All that's needed for this type of transaction is a confirmed, U.S. bank account, with enough funds to cover the whole payment. In the case of instant payment. You can do it anytime, tasks are simple and best of all it's an easy, quick and fun way to make money! Hope you guys have fun and enjoy the basically free. Other payment providers, such as PayPal Express Checkout, will have their own ways of getting funds from your customer to you. Check with the service you're. A mini, simplified guide showing you all how to make some free and easy money! (My guide will show you how to make a very easy and free £36). 4. Download Apps & Get Paid Every Day. One of our new favorite ways for getting free PayPal cash involves using Kashkick, a leading rewards platform. Log into PayPal and make sure that your business bank accounts are linked. Then, pick the type of money transfer you'd like to make. Your three options are. If you're looking to get some free PayPal cash as fast as possible, Survey Junkie's paid surveys might be what you're looking for. It's one of the best survey. How to request money online? · Launch your PayPal app, then choose Request at the bottom of the screen. · Enter the amount of money you want to send. Choose a. $25 Sign up Bonus Instant Withdraw App No Deposit PayPal New Updated [Z3Nq!] instant withdraw , sign up and get free money. Some of these $25 sign up. How to Earn Free PayPal Money Instantly. There are several ways to earn free PayPal money instantly. · Participate in Paid Surveys. Taking surveys is one of the. Yes! You can get free PayPal cash in several ways. One of the easiest ways to do it is to join one of the survey sites that pay out free. Start sending money to your loved ones and friends effortlessly with PayPal. Transfer funds securely and swiftly from your bank account or PayPal balance. Track your credit score for free. Your VantageScore ® by Experian® is Grow your money effortlessly with instant transfers when you get paid. Set. If you're looking for a way to get free PayPal Money, Freeward is an excellent option. · PayPal payments are free and have no minimum, as long as both users have. The standard withdrawal takes longer, but is usually fee-free - you'll pay a charge to get your money faster with instant transfer. Here's how you can use. InboxDollars. If you're looking for another platform to earn PayPal money, check out InboxDollars. Accessible as both a user-friendly website and mobile app. You can earn free PayPal money by completing online tasks for money. There are many websites that offer tasks such as data entry, writing reviews, proofreading. You can also receive PayPal payments from freelancing work regardless of the country in which the two parties are located. When someone sends a payment through. Use the no-cost1 Direct Deposit service and you could have access to your funds up to 2 days faster2 than what traditional banks offer. Make transfers3 from. Transfer money quickly and securely with PayPal. Send money online to friends and family in the US for free when you use your PayPal balance or bank account.

Apps That Cash Out Instantly

So basically every 2 months you could easily cash out $5. This app isn't I've received credit for that right away, which was surprising to me. I. Request an Instant Payout · From the Home or Balances tab, click Pay out funds to check your available balance. · If you're eligible for Instant Payouts and have. Games That Pay Instantly to Your Cash App Account · InboxDollars · QuickRewards · MyPoints · Swagbucks · Brainbattle · Mistplay · CashOut · CashPirate Buzz. Varo Best Overall, Best for Fast Funding With a Low Fee, $20 to $, Instant ; Payactiv Runner-Up Best Overall, Best for Flexible Loan Amounts, Up to $1, Earned Wage Access Made Convenient. The Visa® Rain Card provides an enhanced cash out experience as an additional instant transfer destination with lower fees. QuickRewards stands out as one of the fastest-paying survey sites globally, with a minimum withdrawal threshold of just $ If you dislike sites with high. Your first survey pays $1 in free cash. We offer instant cashouts to PayPal and 70+ gift cards. Our gift card rewards include Amazon Gift Cards, Visa, and. The Drop app enables you to earn cash back when you shop at your favorite stores. It's also one of the simplest apps for earning money since there is no need to. Withdrawal Transfer Speed Options Cash App offers standard transfers to your bank account and Instant transfers to your linked debit card. Standard transfers. So basically every 2 months you could easily cash out $5. This app isn't I've received credit for that right away, which was surprising to me. I. Request an Instant Payout · From the Home or Balances tab, click Pay out funds to check your available balance. · If you're eligible for Instant Payouts and have. Games That Pay Instantly to Your Cash App Account · InboxDollars · QuickRewards · MyPoints · Swagbucks · Brainbattle · Mistplay · CashOut · CashPirate Buzz. Varo Best Overall, Best for Fast Funding With a Low Fee, $20 to $, Instant ; Payactiv Runner-Up Best Overall, Best for Flexible Loan Amounts, Up to $1, Earned Wage Access Made Convenient. The Visa® Rain Card provides an enhanced cash out experience as an additional instant transfer destination with lower fees. QuickRewards stands out as one of the fastest-paying survey sites globally, with a minimum withdrawal threshold of just $ If you dislike sites with high. Your first survey pays $1 in free cash. We offer instant cashouts to PayPal and 70+ gift cards. Our gift card rewards include Amazon Gift Cards, Visa, and. The Drop app enables you to earn cash back when you shop at your favorite stores. It's also one of the simplest apps for earning money since there is no need to. Withdrawal Transfer Speed Options Cash App offers standard transfers to your bank account and Instant transfers to your linked debit card. Standard transfers.

Cash out with Instant Pay up to 6 times per day. Female driver. hourglass app for Android Download the Uber app for IOS. © Uber Technologies Inc. Download the app and create an account · Purchase bingo cards using real money · Play bingo games and win cash prizes · Withdraw your winnings. Cash out is free unless you select instant deposit which is % % - %, with a minimum fee of $ This applies to personal and business accounts. Swagbucks is one of the best apps for anyone looking to be paid to their PayPal with games that pay real money. All you have to know is that. Surveytime rewards users $1 for completing short surveys on their smartphones. You can instantly cash out your earnings with no waiting period. Roadie's Instant Pay option lets drivers cash out instantly. To qualify for In the main menu of the Roadie app, you'll see an Instant Pay prompt below your. When you use your Cash Card to withdraw cash from ATMs, Cash App may reimburse the fees charged by the ATM provider. This feature not only helps you save money. You can cash out through a check or transfer earnings to the Cash App via PayPal. FeaturePoints: This app offers various ways to earn points, including games. A cash advance can help you pay your bills and cover other expenses. Download Gerald's cash advance app to get money fast. Sign up to get quick cash today. Cash out is instantly into PayPal account. (I have cashed out and got my PayPal credit) New survey everyday. Would recommend. Fantastic app. Instant PayPal. 12 Apps That Pay You Money to Sign Up · Swagbucks. Swagbucks is a service that offers free cash and free gift cards for shopping online, playing video games. Yes, Swagbucks is one the most trusted instant payout apps. Swagbucks gives out 7, gift cards every day. Since Swagbucks has already paid out more than. Many game apps like Bingo Cash, Solitaire Smash, and Pool Payday let you earn real cash instantly by playing your favorite games. These apps. If you've been searching for game apps that pay instantly to Paypal, you've likely come across Appstation. This app will pay real money when you try out. Swagbucks stands out as a versatile platform to earn real money with games and other activities. Its user-friendly interface offers a variety of ways to make. What you get: $5 cash added to your account balance. When: Instantly upon confirming your email address. Instant withdrawals: Available to withdraw. You can use Express Pay to cash out your earnings anytime. Earnings can appear within a few hours or days, depending on your bank's processing time. The fastest payout methods for instant casino withdrawals · PayPal. PayPal, a globally trusted e-wallet, guarantees quick and safe transactions, freeing your. Swagbucks is one of the best apps for anyone looking to be paid to their PayPal with games that pay real money. All you have to know is that. When you use your Cash Card to withdraw cash from ATMs, Cash App may reimburse the fees charged by the ATM provider. This feature not only helps you save money.

Wash Sale Gain

A wash sale is a transaction in which the owner of stock or securities realizes a loss on their sale or other disposition, and reacquires substantially. What if my wash sale is a loss? · Buy substantially identical stock or shares · Gain substantially identical stocks or shares in a taxable trade · Obtain an option. The wash-sale rule keeps investors from selling at a loss, buying the same (or "substantially identical") investment back within a day window and claiming. A wash sale is trading activity in which shares of a security are sold at a loss and a substantially identical security is purchased within 30 days. The. Once a transaction's loss is deferred because of the wash sale rule the basis of the stock currently acquired/held is adjusted upward by the amount of the. The IRS rule specifies that the only way to reestablish and mark a loss against your overall taxable gain is after 30 days from your last closing order. Getting. If you had at least one tax lot sold at a loss, you will have a wash sale when you buy back in. You can review the gain/loss by tax lot for your. This means you can't deduct your capital loss for that stock from your taxes after all because you've carried the trade over to Note: Wash sale rules. The wash-sale rule prevents investors from claiming investment losses if they purchase a substantially identical security within 30 days before or after the. A wash sale is a transaction in which the owner of stock or securities realizes a loss on their sale or other disposition, and reacquires substantially. What if my wash sale is a loss? · Buy substantially identical stock or shares · Gain substantially identical stocks or shares in a taxable trade · Obtain an option. The wash-sale rule keeps investors from selling at a loss, buying the same (or "substantially identical") investment back within a day window and claiming. A wash sale is trading activity in which shares of a security are sold at a loss and a substantially identical security is purchased within 30 days. The. Once a transaction's loss is deferred because of the wash sale rule the basis of the stock currently acquired/held is adjusted upward by the amount of the. The IRS rule specifies that the only way to reestablish and mark a loss against your overall taxable gain is after 30 days from your last closing order. Getting. If you had at least one tax lot sold at a loss, you will have a wash sale when you buy back in. You can review the gain/loss by tax lot for your. This means you can't deduct your capital loss for that stock from your taxes after all because you've carried the trade over to Note: Wash sale rules. The wash-sale rule prevents investors from claiming investment losses if they purchase a substantially identical security within 30 days before or after the.

This raises your cost basis, which may save you money on your capital gains tax later—or if you sell the investment at a loss in the future, you may be able to. Selling stocks at a loss can offset capital gains or taxable income, offering potential tax benefits for investors. Designed to prevent abuse, it disallows. Does the wash sale rule apply to gains? No, any time you sell a stock for a profit in a taxable account, you'll get a capital gain. If you want to repurchase. Wash sales ONLY apply to losses. Therefore, if there is a gain on the disposition of stock or options, by definition there is no wash sale. . Basis - the. So, if you sell the replacement stock later, any taxable gain will be smaller, and any deductible loss will be larger. A wash sale is categorized as when an investor sells a stock or security and repurchases the same or substantially identical security within 30 days of the. If you trigger a wash sale, the amount of loss that is not deductible will be added to the cost of the newly purchased, substantially identical stock. This. When you sell an investment at a loss, the IRS lets you deduct the loss from other capital gains you might have and your taxable income. If you want to. This approach encourages you to sell some stock at a loss in order to cut capital gains tax you may owe on other stocks you've sold (or potentially income tax. The wash sale is reported in Box 1g of Form B. Note: Wash sales are in scope only if reported on Form B or on a brokerage or mutual fund statement. Wash-sale rules prohibit investors from selling a security at a loss, buying the same security again, and then realizing those tax losses through a reduction in. The wash sale rule prohibits taxpayers from claiming a loss on the sale or other disposition of a stock or securities if, within the day period that begins. A wash sale is not considered a true sale of a stock or other security for tax purposes, so those losses cannot legally be used to offset capital gains or. A wash sale For more information about wash sales, read IRS Publication , Investment Income and Expenses (Including Capital Gains and Losses). Brokers track and report wash sales within the same account and include the sales in the gain and loss report to the IRS. However, if the trades are in. You might think that you could sell the stock at a loss (for a tax deduction), then turn around and buy more (within 30 days) to hold for a future gain. Not so. If you sell stock at a loss, you'll have a wash sale (and won't be able to deduct the loss) if you buy substantially identical stock within the day wash sale. A wash sale is a sale of a security (stocks, bonds, options) at a loss and repurchase of the same or substantially identical security shortly before or. Wash Sales. The Wash-Sale rule was created by the IRS to disallow the loss deduction from the sale of securities if repurchased by a seller or spouse within.

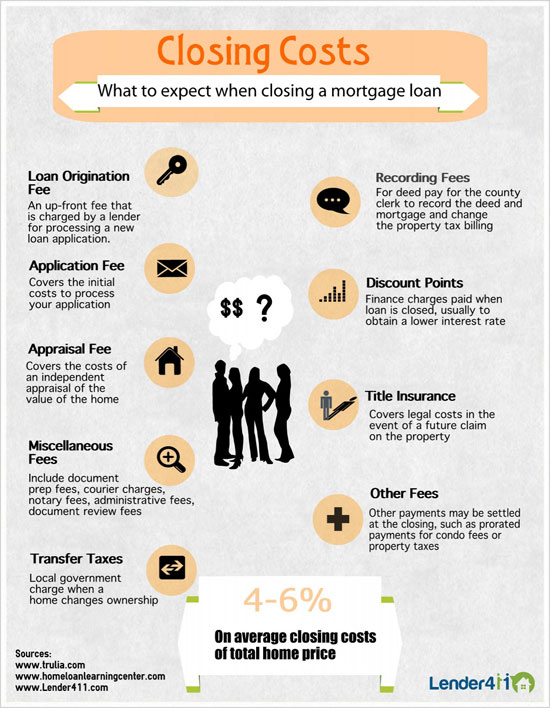

What Are Considered Closing Costs

Closing costs are things that have to be paid in order to close on your home, like property taxes, homeowners insurance, title search fees, appraisal fees, etc. Closing costs typically make up around 3 – 6% of the loan amount. This can be a substantial amount of money that is difficult to pay out of pocket. While it's. Home-buying closing costs can include attorney fees, property appraisals, and mortgage fees. Sometimes these are fixed costs, and other times they're negotiable. There are three types of closing costs that will show up on your Loan Estimate: Origination Charges, Services You Cannot Shop For, and Services You Can Shop. Buyers in California should expect to pay approximately % in closing costs on a purchase. · Points: Each point is equal to 1% of the loan amount. · Application. Closing costs might also include other fees specific to your particular lender or due to other circumstances. Title Insurance in Northeast Florida. titile. Closing costs are fees charged by your lender, real estate agent and other third parties involved in the homebuying transaction. The fees include various. What Are Closing Costs? · What You're Paying For · Application Fees · Appraisal Fees · Attorney Fees · State Taxes · Escrow Fees · How Much Will It All Cost? Closing costs average between 2% - 6% of the loan amount. Mortgage closing costs include fees, points and other charges to buy, refinance or sell a home. Closing costs are things that have to be paid in order to close on your home, like property taxes, homeowners insurance, title search fees, appraisal fees, etc. Closing costs typically make up around 3 – 6% of the loan amount. This can be a substantial amount of money that is difficult to pay out of pocket. While it's. Home-buying closing costs can include attorney fees, property appraisals, and mortgage fees. Sometimes these are fixed costs, and other times they're negotiable. There are three types of closing costs that will show up on your Loan Estimate: Origination Charges, Services You Cannot Shop For, and Services You Can Shop. Buyers in California should expect to pay approximately % in closing costs on a purchase. · Points: Each point is equal to 1% of the loan amount. · Application. Closing costs might also include other fees specific to your particular lender or due to other circumstances. Title Insurance in Northeast Florida. titile. Closing costs are fees charged by your lender, real estate agent and other third parties involved in the homebuying transaction. The fees include various. What Are Closing Costs? · What You're Paying For · Application Fees · Appraisal Fees · Attorney Fees · State Taxes · Escrow Fees · How Much Will It All Cost? Closing costs average between 2% - 6% of the loan amount. Mortgage closing costs include fees, points and other charges to buy, refinance or sell a home.

What Are Closing Costs? · What You're Paying For · Application Fees · Appraisal Fees · Attorney Fees · State Taxes · Escrow Fees · How Much Will It All Cost? What costs are due at closing? · Credit report fee · Attorney fees (if applicable) · Escrow fees · Closing protection letter (CPL) fee · Notary fees · HOA dues or. Title Reporter Series #3 · It's the big day. · It's also the day that you and the seller will pay "closing" or settlement costs, an accumulation of separate. The typical closing costs on a house (when you're the seller) can range from about 8% – 10% of the sales price. Let's break down the closing costs into the. Closing costs refer to a variety of fees and expenses incurred by parties in the finalization of a deal that are not part of the negotiated price. Closing costs refer to the expenses associated with buying property. These settlement costs are fees paid by purchasers upon receipt of their loan from their. Closing costs are things that have to be paid in order to close on your home, like property taxes, homeowners insurance, title search fees, appraisal fees, etc. Closing costs usually range from 2% to 5% of the price of your mortgage loan amount. · What sets apart Texas United Mortgage from most lenders, is that. These costs include items such as fees for processing, title insurance/search (title closing fee), mortgage taxes, appraisals, closing, and more. They're. Closing costs are fees associated with purchasing a home, such as recording costs, appraisal fees, mortgage fees, and attorney fees. Closing costs are typically. FHA loans and down payments allow most closing costs to be included in the loan which can be very helpful if you don't have the cash required to close. A real estate commission, the largest fee for the transaction (up to 6% of the total cost of the property) is considered a closing cost, but that is paid by the. What is included in mortgage closing costs? Buyer closing costs include: Mortgage application. This is a fee that may be charged at the start of the loan. Pre-paid expenses are not a fee, but are costs associated with the home that are paid in advance when closing on a loan. These include Property Taxes. Property taxes, homeowners' insurance, and mortgage insurance premiums are prepaid closing costs. With no-closing-cost mortgages, the lender rolls the closing. Closing fees are a cost associated with the transfer of ownership during the home purchasing process. These fees are required to officially complete a real. Document Preparation: This fee covers the cost of preparation of final legal papers, such as a mortgage, deed of trust, note or deed. Notary: This fee is. Closing costs may include origination and underwriting fees, real estate commissions, taxes, and insurance premiums, as well as title and record filings. What costs are due at closing? · Credit report fee · Attorney fees (if applicable) · Escrow fees · Closing protection letter (CPL) fee · Notary fees · HOA dues or. Common closing costs include lender fees, attorney and title fees, title insurance, taxes, prepaid insurance, prepaid property taxes, and HOA fees. . Do you.

How To Make Quick Money Crypto

Making money with cryptocurrency is possible, though it comes with risks due to its volatility. Trading cryptocurrencies offers potential. To earn passive income with crypto, consider staking or lending your coins through reputable platforms, earning rewards for holding them. 8 Proven Ways for Making Money with Crypto · 1. Mining · 2. Staking · 3. Trading · 4. Investing · 5. Lending · 6. Earning Interest · 7. Affiliate Programs · 8. ICOs. Staking is a way long-term crypto investors (“HODLers”) earn passive income in the crypto world. · Staking cryptocurrency means agreeing not to trade or sell. Airdrops farming. It's tedious work tho, but if you got money to spare. Buy a few decent nodes, stake a few coins, and you'll make money. · Once. I have done this and have earned more on cryptocurrency than I have in businesses (the second biggest income generator), the stock market, and real estate. Crypto Passive Income: 8 Ways to Earn () · Cryptocurrency interest rewards · Dividend earning tokens · Staking · Crypto lending · Play-to-earn games. With the right property, you can earn passive income and enjoy the fruits of your labor from crypto trading for a long time. You can even save part of your. Want to know how to earn passive income from crypto? There are plenty of ways from staking to yield farming to liquidity provision. Learn more in our guide. Making money with cryptocurrency is possible, though it comes with risks due to its volatility. Trading cryptocurrencies offers potential. To earn passive income with crypto, consider staking or lending your coins through reputable platforms, earning rewards for holding them. 8 Proven Ways for Making Money with Crypto · 1. Mining · 2. Staking · 3. Trading · 4. Investing · 5. Lending · 6. Earning Interest · 7. Affiliate Programs · 8. ICOs. Staking is a way long-term crypto investors (“HODLers”) earn passive income in the crypto world. · Staking cryptocurrency means agreeing not to trade or sell. Airdrops farming. It's tedious work tho, but if you got money to spare. Buy a few decent nodes, stake a few coins, and you'll make money. · Once. I have done this and have earned more on cryptocurrency than I have in businesses (the second biggest income generator), the stock market, and real estate. Crypto Passive Income: 8 Ways to Earn () · Cryptocurrency interest rewards · Dividend earning tokens · Staking · Crypto lending · Play-to-earn games. With the right property, you can earn passive income and enjoy the fruits of your labor from crypto trading for a long time. You can even save part of your. Want to know how to earn passive income from crypto? There are plenty of ways from staking to yield farming to liquidity provision. Learn more in our guide.

Merchants who accept cryptocurrency payments when the market is tanking might very well luck into quick profits if market sentiment turns favorable. In the early days of Bitcoin, if you weren't a miner, one of the few ways to acquire it was by using a Bitcoin faucet that dispensed BTC every time you. Are you new to the NFT marketplace and wondering how you can earn crypto with NFTs? This guide explains ways to make crypto for beginners. There are several ways to generate passive income with cryptocurrency, including yield-farming through lending or providing liquidity on defi platforms. This beginner's guide discusses how to make money with cryptocurrency using 10 proven methods. Start making crypto profits today. How to Start Making Money with Crypto?8 Proven Ways for Making Money with Crypto1. Mining2. Staking3. Trading4. Investing5. Lending6. Earning Interest7. All are lower-income and ten are in the Caribbean (Nigeria is the eleventh). In , China began counting its piloted CBDC in official currency circulation. You can earn by: Lending crypto: Loan your coins to others and earn interest. Borrowing crypto: Obtain funds by collateralising your existing crypto holdings. You can also learn to trade past the 10% mark maybe 12 to 14% to allow some room to make the extra money needed to pay the trading fees. 12 Ways You Can Earn Passive Income With Crypto · 1. Proof-of-Stake (PoS) Staking · 2. Interest-Bearing Digital Asset Accounts · 3. Lending · 4. Cloud Mining. How to Make Money with Cryptocurrency – 10 Easy Ways · Way#1. Buy and HODL · Way#2. Earn Cryptocurrency Dividends · Way#3. Run Cryptocurrency Master Nodes · Way. Investing or trading cryptocurrencies can be a profitable venture, but it requires patience and a deep understanding of the market to make. 1. Coinbase learning rewards. The easiest way to start generating crypto rewards on Coinbase is through Coinbase Earn. · 2. Stake some of your crypto · 3. Turn. Users can enjoy a better annual rewards rate when they have a Cardholder CRO Stake or CRO Lockup. Please refer to the Crypto Earn page for locking up amounts in. You can also learn to trade past the 10% mark maybe 12 to 14% to allow some room to make the extra money needed to pay the trading fees. 1. Investing. One of the most popular strategies in making money with cryptocurrency is investing. · 2. Crypto Lending · 3. Trading · 4. Mining · 5. Staking · 6. Today, crypto trading is known as one of the easiest ways of making money to become rich quickly. Although it comes with it a huge risk, crypto investment is. By contrast, when you buy cryptocurrencies on an exchange, you buy the coins themselves. You'll need to create an exchange account, put up the full value of the. Here we will help you understand how to make money from Bitcoin. Whether you're curious about investing, trading, or other ways to get involved, we'll break it. How to Make Money with Bitcoin? · 1. HODLing - The Long-Term Approach · 2. Day Trading - The Game of Quick Returns · 3. Mining - Earning through Network Support.

United States Income Tax Brackets 2021

The tax rates themselves are the same as the rates in effect for the tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. As of , there are currently seven federal tax brackets in the United States, ranging from 10% to 37%. Single filers for tax year who have less than. Schedule P, Kentucky Pension Income Exclusion. For all individuals who are retired from the federal government, the Commonwealth of Kentucky, or a Kentucky. Marginal tax rates ; $82, – $, ; $, – $, REDUCTION IN INDIVIDUAL INCOME TAX RATES – The top marginal Individual Income Tax rate is % on taxable income. Use the SCTT, Tax Tables, to. Tax Brackets ; Tax Rate, Single Filers, Married Filing Jointly, Heads of Household ; 10%, up to $9,, up to $19,, up to $14, ; 12%, $9, to $40, A listing of the Utah individual income tax rates. These are marginal rates, meaning that each rate applies only to a specific slice of income, rather than to your total income. What are the federal income. The tax rates themselves are the same as the rates in effect for the tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. As of , there are currently seven federal tax brackets in the United States, ranging from 10% to 37%. Single filers for tax year who have less than. Schedule P, Kentucky Pension Income Exclusion. For all individuals who are retired from the federal government, the Commonwealth of Kentucky, or a Kentucky. Marginal tax rates ; $82, – $, ; $, – $, REDUCTION IN INDIVIDUAL INCOME TAX RATES – The top marginal Individual Income Tax rate is % on taxable income. Use the SCTT, Tax Tables, to. Tax Brackets ; Tax Rate, Single Filers, Married Filing Jointly, Heads of Household ; 10%, up to $9,, up to $19,, up to $14, ; 12%, $9, to $40, A listing of the Utah individual income tax rates. These are marginal rates, meaning that each rate applies only to a specific slice of income, rather than to your total income. What are the federal income.

Tax Year · Prior Years · Contact Us · About · Connect · Popular. Historical Tax Tables may be found within the Individual Income Tax Booklets Call GEORGIA to verify that a website is an official website of the State. Personal income tax rates ; Single taxpayers (1) · 0 to 11, · 11, to 44, ; Married taxpayers filing jointly (1, 2) · 0 to 22, · 22, to 89, ; Head-of-. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, Source: IRS Revenue Procedure Table 4. Personal Exemptions, Standard Deductions, Limitation on Itemized. Deductions, Personal Exemption Phaseout. The American Taxpayer Relief Act of increased the highest income tax rate to percent. The Patient Protection and Affordable Care Act added an. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, Federal Income Tax Rates ; Caution: Do not use these tax rate schedules to figure taxes. Use only to figure estimates. In , the top marginal tax rate was reduced from % to % beginning with Tax Year However, the top marginal ordinary tax rate was further reduced. Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Step 2: Apply the Tax Rates to Each Bracket · The first $11, of your taxable income is taxed at 10%. · The next portion of $33, (from $11, to $44,) is. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. Source: IRS Revenue Procedure Table 4. Personal Exemptions, Standard Deductions, Limitation on Itemized. Deductions, Personal Exemption Phaseout. Historical Tax Tables may be found within the Individual Income Tax Booklets Call GEORGIA to verify that a website is an official website of the State. Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. What Are the U.S. Federal Tax Brackets for ? ; Tax Rate, Single Filers Tax Brackets, Head of Household Tax Brackets, Marries Filing Jointly or Qualifying. Maryland's 23 counties and Baltimore City levy a local income tax which we collect on the state income tax return as a convenience for local governments. The. Pay your taxes. Get your refund status. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities. Colorado income tax is based generally on federal taxable income, although various modifications and adjustments are made in the calculation of Colorado income.

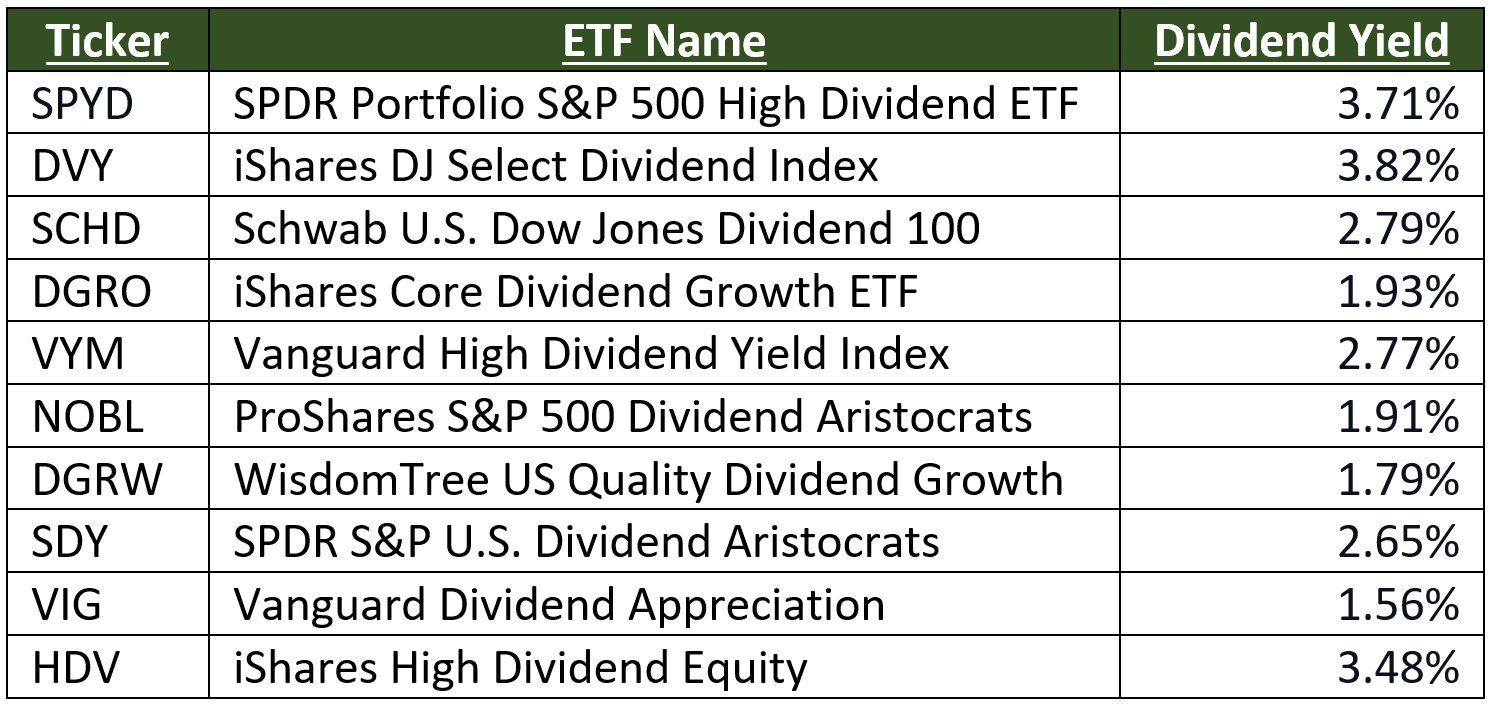

Healthcare Dividend Etf

When it comes to the best healthcare ETFs, the Health Care Select Sector SPDR Fund (XLV, $) is the leader as far as assets under management. It's. Dividends and capital gains on securities issued in the The health care sector may be affected by government regulations and government health care. Vanguard Health Care ETF (VHT) - Find objective, share price Dividend income and capital gains. Type, $/Share, Payable date, Record date, Ex. TD Global Healthcare Leaders Index ETF (TDOC) can provide diversified healthcare exposure through a single one-stop solution. Managed by TD Asset Management Inc. MHCD offers exposure to dividend-paying healthcare, life sciences, and biotech companies. Benefit from this actively managed, low-cost fund. A BMO ETF will have taxable income if the income generated (for example interest, dividend, capital gains, etc.) by the securities within the BMO ETF is greater. The iShares Global Healthcare ETF seeks to track the investment results of an index composed of global equities in the healthcare sector. Why IXJ? 1. Exposure. A healthcare ETF is an exchange-traded fund that invests in a diversified portfolio of healthcare companies, such as pharmaceutical, biotechnology, medical. Which healthcare ETF is the best? The annual total expense ratio Global Dividend ETF · S&P ETF · Bitcoin-ETF and -ETN · Nasdaq ETF. ETF. When it comes to the best healthcare ETFs, the Health Care Select Sector SPDR Fund (XLV, $) is the leader as far as assets under management. It's. Dividends and capital gains on securities issued in the The health care sector may be affected by government regulations and government health care. Vanguard Health Care ETF (VHT) - Find objective, share price Dividend income and capital gains. Type, $/Share, Payable date, Record date, Ex. TD Global Healthcare Leaders Index ETF (TDOC) can provide diversified healthcare exposure through a single one-stop solution. Managed by TD Asset Management Inc. MHCD offers exposure to dividend-paying healthcare, life sciences, and biotech companies. Benefit from this actively managed, low-cost fund. A BMO ETF will have taxable income if the income generated (for example interest, dividend, capital gains, etc.) by the securities within the BMO ETF is greater. The iShares Global Healthcare ETF seeks to track the investment results of an index composed of global equities in the healthcare sector. Why IXJ? 1. Exposure. A healthcare ETF is an exchange-traded fund that invests in a diversified portfolio of healthcare companies, such as pharmaceutical, biotechnology, medical. Which healthcare ETF is the best? The annual total expense ratio Global Dividend ETF · S&P ETF · Bitcoin-ETF and -ETN · Nasdaq ETF. ETF.

Breadcrumb · IYH · Dividend History. iShares U.S. Healthcare ETF (IYH) Dividend History. ProShares S&P Ex-Health Care ETF seeks investment results, before fees and expenses, that track the performance of the S&P Ex-Health Care Index. Pacer Metaurus US Large Cap Dividend Multiplier ETF Strategy Health Care, Consumer Discretionary, Communication Services, Industrials. Consider DEM, an ETF that seeks to provide exposure to high dividend Health Care. %. *Sectors are subject to change without notice. Recent. Click to see more information on Healthcare ETFs including historical performance, dividends, holdings, expense ratios, technicals and more. Seeks to provide long-term capital growth by replicating the performance of the S&P Global Health Care Canadian Dollar Hedged Index, net of expenses. Performance charts for Middlefield Healthcare Dividend ETF (LS - Type ETF) including intraday, historical and comparison charts, technical analysis and. JPMorgan Healthcare Leaders ETF ; NAV. As of 08/21/ $ Change$ ; YTD. As of 08/21/ at NAV% ; 30 DAY SEC YIELD. As of 07/31/ %. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and the. Find the latest quotes for iShares U.S. Healthcare ETF (IYH) as well as ETF details, charts and news at south-sudan.ru The Global X Health Care Covered Call & Growth ETF (HYLG) seeks to provide investment results that correspond generally to the price and yield performance. Health Care Index Fund seeks to track the performance of a benchmark index that measures the investment return of health care stocks. The iShares Global Healthcare Index ETF (CAD-Hedged) seeks to provide long-term capital growth by replicating, to the extent possible, the performance of. The Growth of $10, chart reflects a hypothetical $10, investment and assumes reinvestment of dividends and capital gains. Fund expenses, including. The Evolve Global Healthcare Enhanced Yield Fund is an ETF with a covered call strategy that invests in top global healthcare companies. Learn more. Equity securities · Select Sector SPDR Funds · Non-diversified funds · Passively managed funds · ETFs · Intellectual Property Information: · Before investing. The Simplify Health Care ETF (PINK) seeks long term capital appreciation by providing investors with multi-cap exposure to groundbreaking and innovative. Movers in US Health Care ; PSCH. Invesco S&P SmallCap Health Care ETF, +% ; BTEC. Principal Healthcare Innovators ETF, +% ; RSPH. Invesco S&P ® Equal. The largest Healthcare ETF is the Health Care Select Sector SPDR Fund XLV with $B in assets. In the last trailing year, the best-performing Healthcare ETF. The XLV, or Healthcare Sector ETF, primarily includes health care equipment & supplies, health care providers & services, biotechnology, and pharmaceuticals.

Best Homeowners Insurance Delaware

The best way to determine if you have enough coverage for your belongings is to Shop around: A list of companies offering home insurance in Delaware is. home. Avg. premium for $k dwelling coverage $ 5, /yr Best home insurance in Delaware. Delaware city. Sort arrow ascending. Sort arrow descending. Average. Following an in-depth analysis, Bankrate determined Allstate, Travelers, State Farm and Nationwide are among the best home insurance companies in Delaware. Cheapest Car Insurance in Delaware: State Farm According to our study of car insurance rates, the cheapest company in Delaware is State Farm at $1, per. Top 10 Best Homeowners Insurance in Lewes, DE - August - Yelp - Allstate Insurance: Paul Sarnak, Kim Benton - State Farm Insurance Agent. The Williams Insurance Agency, Inc. has been a trusted name in providing homeowner's insurance coverage to Delaware residents since SelectQuote shops and compares home and auto insurance rates from dozens of our trusted carriers to find you the lowest price. Westfield and Erie are the best home insurance companies based on rates, customer complaints, discounts and coverage offerings. Progressive and Nationwide. Liberty Mutual understands the needs of Delaware homeowners and offers customized homeowners insurance coverage to fit your specific situation. The best way to determine if you have enough coverage for your belongings is to Shop around: A list of companies offering home insurance in Delaware is. home. Avg. premium for $k dwelling coverage $ 5, /yr Best home insurance in Delaware. Delaware city. Sort arrow ascending. Sort arrow descending. Average. Following an in-depth analysis, Bankrate determined Allstate, Travelers, State Farm and Nationwide are among the best home insurance companies in Delaware. Cheapest Car Insurance in Delaware: State Farm According to our study of car insurance rates, the cheapest company in Delaware is State Farm at $1, per. Top 10 Best Homeowners Insurance in Lewes, DE - August - Yelp - Allstate Insurance: Paul Sarnak, Kim Benton - State Farm Insurance Agent. The Williams Insurance Agency, Inc. has been a trusted name in providing homeowner's insurance coverage to Delaware residents since SelectQuote shops and compares home and auto insurance rates from dozens of our trusted carriers to find you the lowest price. Westfield and Erie are the best home insurance companies based on rates, customer complaints, discounts and coverage offerings. Progressive and Nationwide. Liberty Mutual understands the needs of Delaware homeowners and offers customized homeowners insurance coverage to fit your specific situation.

Delaware doesn't legally require homeowners to have insurance on their property, but if you finance your home through a mortgage, your lender will likely. If you haven't switched carriers in a few years, your best bet is to make a move to another. Car/home repair costs are skyrocketing and premiums. Nationwide offers the cheapest homeowners insurance in Delaware, based on our findings. State Farm and Allstate are also relatively affordable, depending on. We'll help you decide which insurance products and services best fit your needs. Homeowners Insurance in Delaware. auto insurance definition. Car Insurance in. Save up to 20% when you switch to Allstate without a recent home insurance claim. See other ways to save on home insurance in Delaware. discover discounts. Travelers and State Farm have the overall cheapest car insurance in Delaware for good drivers, based on the companies in our analysis. The Cheapest Car. This is why MHIS is the best choice for mobile home insurance; we guarantee that you will be satisfied with our service. What is the difference between. Insley Insurance & Financial Services services individuals and business owners in Delaware. It helps clients apply for the best homeowners' insurance plans that. As Delaware residents know, it's good to be first. And while we weren't the first home insurance provider to start operating within its state borders, we are. Our agents will create a homeowner's insurance policy that will best suit you and your family. Typically, a basic home insurance policy in Maryland. Best Homeowners Insurance in Delaware (). Travelers is Delaware's best home insurance provider, with a MoneyGeek score of 91 out of and an average. It is best to give your agent copies of the association's master policy and There are many resources to assist you in obtaining homeowners insurance. On average, what is the cheapest insurer in Delaware? Travelers is the cheapest insurer in Delaware, with premiums as low as $ For more options, check cheap. Choosing your home insurance can be a complex and stressful experience. If you need help, Harry J. Insley has the expertise to ensure you're getting coverage. Top 24 home insurance companies in Delaware · 1. Lyons Companies · 2. Farmers of Salem · 3. Williams Insurance Agency Rehoboth/Wilmington · 4. L&W Insurance · 5. The average homeowner insurance premium in Delaware is around $ which is $ cheaper than the national average. However, depending on your coverage. Because of its coastal location, Delaware homes have a unique exposure to loss. You can depend on the EZ Coastal Insurance team to get it right. Compare the average homeowners insurance rates in Delaware in the table below for four of the largest home insurance providers in the state. Of these companies. Are you looking for affordable home insurance in Delaware? Let InsureOne Insurance help you find the best, most cost-effective coverage possible. Competitive Rates: Ashley Insurance offers affordable home insurance quotes in Delaware. We believe that protecting your home shouldn't break the bank. Expert.

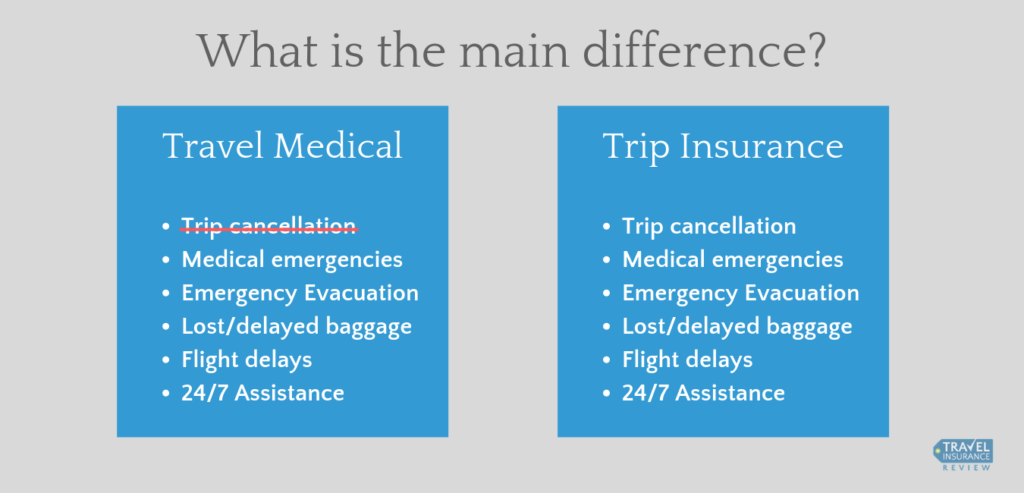

How Much Travel Medical Insurance Do I Need

Going abroad? Get travel medical coverage before your trip. Learn more about international health insurance costs to choose best option for your needs. What does Travel Medical Insurance cover? Some of the other important travel Do visitors to US need health insurance? Is visitor visa insurance USA. Cost of travel insurance: Travel insurance usually costs between % of a trip's price. For example, for a trip that costs $5,, travel insurance could. VisitorsCoverage offers US visitor insurance, international travel medical insurance, trip insurance, and more. Compare travel insurance plans and buy. The first question you should be answering is how long you need insurance for. If you're on a short-term trip of a few months or less, then you might want to. On average, premiums can range from $2 to $10 per day. Deductibles: Some plans require you to pay a deductible before the insurance coverage kicks in. Travel insurance can minimize the considerable financial risks of traveling: accidents, illness, missed flights, canceled tours, lost baggage, theft, terrorism. GeoBlue international medical insurance provides travelers with access to Blue Cross Blue Shield Travel health insurance coverage around the globe. For those that do, the coverage is often limited and requires you to Travel medical insurance plans typically cover emergency medical and dental costs. Going abroad? Get travel medical coverage before your trip. Learn more about international health insurance costs to choose best option for your needs. What does Travel Medical Insurance cover? Some of the other important travel Do visitors to US need health insurance? Is visitor visa insurance USA. Cost of travel insurance: Travel insurance usually costs between % of a trip's price. For example, for a trip that costs $5,, travel insurance could. VisitorsCoverage offers US visitor insurance, international travel medical insurance, trip insurance, and more. Compare travel insurance plans and buy. The first question you should be answering is how long you need insurance for. If you're on a short-term trip of a few months or less, then you might want to. On average, premiums can range from $2 to $10 per day. Deductibles: Some plans require you to pay a deductible before the insurance coverage kicks in. Travel insurance can minimize the considerable financial risks of traveling: accidents, illness, missed flights, canceled tours, lost baggage, theft, terrorism. GeoBlue international medical insurance provides travelers with access to Blue Cross Blue Shield Travel health insurance coverage around the globe. For those that do, the coverage is often limited and requires you to Travel medical insurance plans typically cover emergency medical and dental costs.

When you're traveling far from home, international travel medical insurance offers medical If I'm healthy, do I need travel medical insurance? Accidents. In some cases, a homeowners policy will cover the costs of repairing or replacing property damaged or lost during travel. and Medical Evacuation Travel. Get a quote, compare plans and buy Allianz travel insurance online. Trip protection for cancellations, emergency medical & more. Over 70M policies sold. Travel insurance and assistance with UnitedHealthcare Global's SafeTrip international travel insurance plans - medical, accident, trip cancellation and. Travel health insurance is especially important if you have an existing health condition, are traveling for more than 6 months, or doing adventure activities. While travel insurance costs vary, the average is somewhere between % of your total trip cost. A good rule of thumb is to choose a policy maximum that would be high enough to cover the entirety of your medical bills should you need to seek necessary. While there is no legal requirement to have Travel Medical Insurance when you take a trip outside your home province, you are taking a big risk if you travel. The difference is the Trip Insurance quote would reimburse you for cancelled trips, cover baggage, delays, and more. Trip insurance usually costs % of the. However, we recommend $, in case of a longer Medical Evacuation, like from Puerto Rico to California. Of course, if you travel somewhere remote, like. For further abroad, you should look for travel medical policies that include at least $, worth of coverage in both medical and emergency evacuation. Travel insurance protects you should your trip be interrupted or cancelled. Many travel insurance policies provide coverage only if there is a major. In most cases, you can get moderate coverage for $50 or less per person. How much travel health insurance do I need? Coverage needs depend on personal. Many travel agents and private companies offer insurance plans that will cover health care expenses incurred overseas, including emergency services such as. £2m or more for the USA. Any treatment that can wait until you return home (according to medical opinion) wouldn't usually be covered. Getting you. We recommend that you purchase at least $, and preferably $, Comprehensive coverage plans are already expensive and $, is quite expensive. Do. The proper amount of medical coverage for your trip can be difficult to judge. When reviewing the different policies, you'll see that every plan will offer. The short answer: Yes. According to south-sudan.ru, health care you get while traveling outside the US isn't covered. There are a few rare exceptions. Going abroad? Get travel medical coverage before your trip. Learn more about international health insurance costs to choose best option for your needs.

Over Trading Stocks

Similar to regular market sessions, trading occurs on exchanges like the New York Stock Exchange and Nasdaq and through a variety of venues, including market. It's useful to look at stock market levels compared to where they've been over the past few months. When the S&P is above its moving or rolling average. Overtrading can be harder to pinpoint, but if the trader is consistently making only a couple of dollars above commissions, or is making random trades with. This price band is set at a percentage level above and below the average price of the stock over the immediately preceding five-minute trading period. If the. Swing trading is a style of trading that focuses on capturing gains from stock price movements over a period that can range from a few days to several weeks. trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is. Why trade stocks with Fidelity? · $0 commission for online U.S. stock trades · Trading anytime, anywhere to stay connected to the markets and your investments. Stock traders may be an investor, agent, hedger, arbitrageur, speculator, or stockbroker. Such equity trading in large publicly traded companies may be through. One of the biggest challenges stock traders face every day is the inability to short stocks and ETFs easily and consistently. This is often caused by a shortage. Similar to regular market sessions, trading occurs on exchanges like the New York Stock Exchange and Nasdaq and through a variety of venues, including market. It's useful to look at stock market levels compared to where they've been over the past few months. When the S&P is above its moving or rolling average. Overtrading can be harder to pinpoint, but if the trader is consistently making only a couple of dollars above commissions, or is making random trades with. This price band is set at a percentage level above and below the average price of the stock over the immediately preceding five-minute trading period. If the. Swing trading is a style of trading that focuses on capturing gains from stock price movements over a period that can range from a few days to several weeks. trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is. Why trade stocks with Fidelity? · $0 commission for online U.S. stock trades · Trading anytime, anywhere to stay connected to the markets and your investments. Stock traders may be an investor, agent, hedger, arbitrageur, speculator, or stockbroker. Such equity trading in large publicly traded companies may be through. One of the biggest challenges stock traders face every day is the inability to short stocks and ETFs easily and consistently. This is often caused by a shortage.

Liquidity — Having liquid shares is vital for day traders for several reasons. First, it enables easy entry and exit points since there's no shortage of buyers. Why trade stocks with E*TRADE from Morgan Stanley? · Pay $0 commissions for US-listed stock trades · Trade online and through our best-in-class E*TRADE Mobile app. Trade your favorite stocks anytime. The 24 Hour Market is here. Trade TSLA Stocks & funds offered through Robinhood Financial. Other fees may apply. Stocks & options are equally easy to trade at the click of a mouse in today's digital world. The hard part is trading profitably on a consistent. Over-the-counter (OTC) securities are securities that are not listed on a major exchange in the United States and are instead traded via a broker-dealer network. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Invest carefully during volatile markets. Traders may not be able to quickly match buyers and sellers to execute your order. The use of options, an advanced. What Happens During a Trading Halt? When a trading halt is implemented for a listed stock, the listing exchange notifies the market that trading is not. Other markets · Commodity markets, which allow the trading of commodities · Derivatives markets, which provide instruments for managing financial risk · Forward. Invest in Stocks · Penny Stocks to Large Cap Stocks · Listed and OTC Stocks · Exchange Traded Funds (ETFs) · Divided Reinvestment Programs · Extended Hours Trading. Trade US Stocks and ETFs, Options and Bonds Around the Clock. React immediately to market-moving news and trade over 10, US Stocks and ETFs, US Equity. Stock traders may be an investor, agent, hedger, arbitrageur, speculator, or stockbroker. Such equity trading in large publicly traded companies may be through. Stocks that can't meet exchange requirements may be traded "over the counter." A trading post for stocks. A stock exchange is simply a marketplace where traders. A company will typically start to sell its shares on an exchange through an initial public offering (IPO) on a primary market, taking it from private ownership. The equities and options exchanges have procedures for coordinated cross-market trading over the phone with the NYSE Trading Operations Desk. Services. Stocks that can't meet exchange requirements may be traded "over the counter." A trading post for stocks. A stock exchange is simply a marketplace where traders. You buy and sell the same stock or ETP (or open and close the same position) within a single trading day; You open and close the same options contracts within a. Determine the direction of your trade. Based on your research, decide if you wish to go long and 'buy' the stock or go short and 'sell'. This is a matter. What Happens During a Trading Halt? When a trading halt is implemented for a listed stock, the listing exchange notifies the market that trading is not. This measures price fluctuations within the markets that can either help traders to gain profits if the trade is executed effectively, or losses if the trade is.